Actual Budget

Long time, no post. Sorry about that!

I’ve been on a medical timeout from cycling, which has given me some extra time to focus on another hobby: rebuilding my homelab. We’re also saving up for a big home renovation, so I’m trying to cut down on expenses—primarily my cloud subscriptions. That homelab journey deserves its own post, but for now, I want to talk about how I’ve started managing my budget.

And yes, I say “started” because this journey only began last October.

I’ve realized that my mindset around spending had shifted from “do I have actual money to pay for this?” to “can I pay for this using my credit card?” This hit me the hardest with my cycling hobby, where I found myself preferring merchants that accepted credit card payments over bank deposits. As a result, a massive chunk of my monthly payout has been going toward credit card bills, leaving me with very little left—a recipe for disaster.

It was time to get on top of my finances. Immediately.

The Problem

Over the years, I’ve tried several budgeting apps, mostly on my phone. The issue? I had to enter transactions manually. At first, it was okay, but over time, it became a chore. Someone once told me, “You don’t need friction in managing your finances,” and they were right. Friction makes it exhausting and unsustainable.

Here’s what I was looking for in a budgeting tool:

- The ability to import my bank’s credit card statements directly.

- No monthly subscription fees—after all, the whole point is to save money!

- Full control over my data.

Unfortunately, the apps I tried either didn’t support importing transactions or required subscriptions to unlock features like bank integration. To make matters worse, none of them supported banks in the Philippines. While some apps could connect to your bank directly, I wasn’t comfortable giving third-party apps even read-only access to my financial data.

This left me in a tough spot: I needed a solution that gave me control, was affordable, and didn’t come with a steep learning curve.

Solution - Actual Budget

Enter Actual Budget.

I recently repurposed a refurbished Lenovo mini PC as a home server for running Docker applications. While exploring containerized apps, I stumbled upon Firefly III, a feature-rich financial manager. However, as someone new to budgeting (yep, budget virgin here1), I found it overwhelming. That’s when I discovered Actual Budget.

Actual Budget started as a paid service but is now open-source, allowing anyone to host their own instance for free. This was exactly what I needed. Their documentation is thorough and beginner-friendly, making it easy to set up my accounts and budgets.

One standout feature is its CSV import support. I can export my credit card data from my bank, transform it into a CSV file, and upload it to Actual Budget. Among my banks, UnionBank stands out for offering clean Excel exports, making the CSV transformation a breeze. Because of this, I’ve started using my UnionBank credit card for most purchases to keep my transactions centralized.

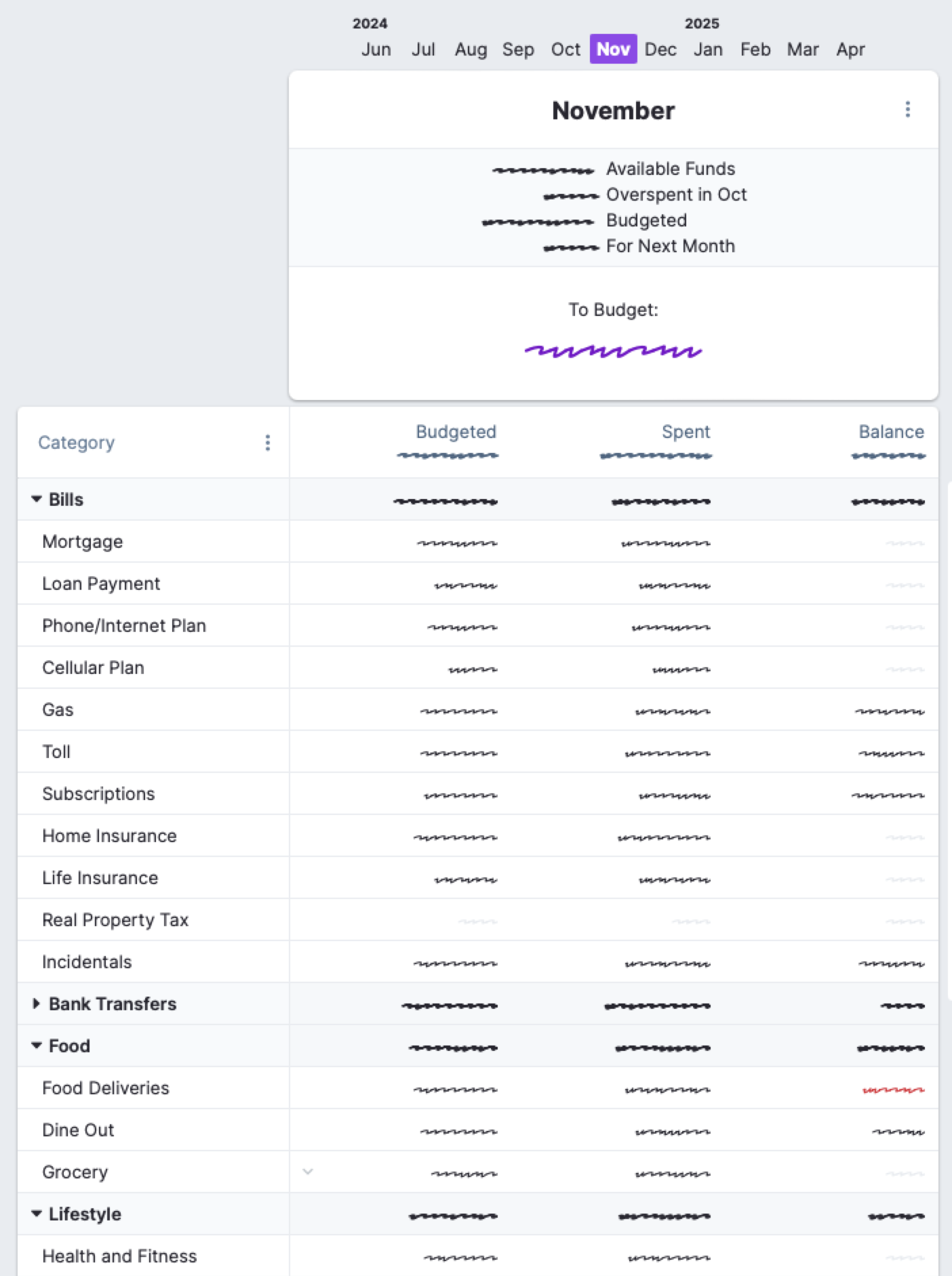

After setting up my accounts, scheduled payments, and budget categories, I finally had a clear picture of my finances:

The results were eye-opening. I noticed a spike in food delivery expenses from Grab and FoodPanda. My wife and I immediately set rules to limit food deliveries to once a week. Small changes like this already helps us in cutting back our expenses.

I’ve also committed to a weekly finance review, which has shifted my mindset back to “do I have spare money to pay for this?” instead of relying on credit cards. For the first time in months, my 13th-month pay isn’t going straight to debt—it’s staying in my savings.

Conclusion

You don’t need to buy a home server or use Actual Budget to get started. A simple Excel spreadsheet or Google Sheet works just as well. Yes, it might feel tedious at first, but you have to start somewhere.

I think a lot of people avoid budgeting because it feels invasive—even when they’re the ones asking the questions! When my mom used to ask me where I spent my money, I’d feel annoyed (“It’s MY money!”). But auditing myself has been a humbling experience. The frustration (“Why do I care so much about cycling gear?”) eventually turns into empowerment.

If anyone can audit your spending effectively, it’s you. For me, as a married man now, I’ve realized I can’t always spend like there’s no tomorrow. Budgeting is a work in progress, but I’m finally on the right track—and I hope this inspires you to take that first step too.

uhm, what? ↩